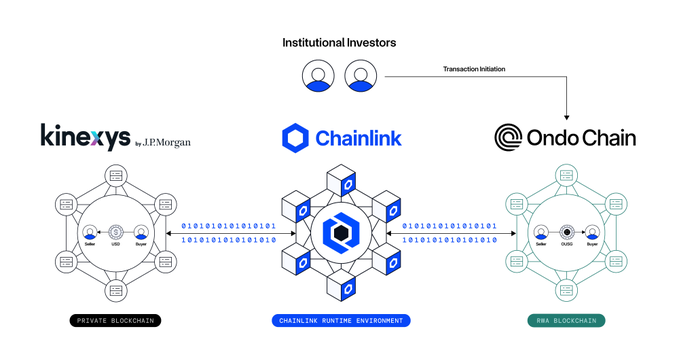

- Chainlink assisted in conducting a cross-chain settlement between Kinexys and Ondo Finance, both projects of JPMorgan, with its Runtime Environment and CCIP.

- The trade was between tokenized U.S. Treasurys and fiat settlements on both public and permissioned networks.

- Although it succeeded, the LINK price fell by 15% since technical indicators shifted to bearish in the short term.

Chainlink has passed a milestone collaboration with Kinexys and Ondo Finance at JPMorgan, making the first-ever cross-chain delivery-versus-payment (DvP) settlement between a privately operated payments network and a public blockchain. The transaction involved tokenized U.S. Treasurys and marks a significant step forward in decentralized financial infrastructure.

This settlement utilized the Chainlink Cross-Chain Interoperability Protocol (CCIP) and was coordinated via the Chainlink Runtime Environment (CRE), an off-chain compute layer built to enable modular, secure interoperability. CRE handled the process by checking escrow conditions on Ondo Chain, initiating payment instructions via Kinexys Digital Payments, and final settlement confirmation.

Contrary to conventional bridges, no assets but merely instructions were moved through networks. This minimizes counterparty risk and simplifies compliance. The asset swapped was OUSG, a tokenized fund of U.S. Treasurys by Ondo Finance. Fiat was, in turn, settled through Kinexys, a permissioned payment network sponsored by JPMorgan.

This transaction represents the first of its kind on the Ondo Chain testnet and demonstrates Kinexys’ capacity to go beyond permissioned settings. Chainlink ensured that CRE could be fully adapted to single- and multi-chain DvP flows, allowing financial institutions to carry out sophisticated cross-chain activity with real-time guarantees and programmable logic.

Real-World Asset Tokenization Reaches $23B in 2025

The collaboration follows the tokenization of real-world assets (RWA), which is experiencing rapid expansion. During the first half of 2025, that market grew by 260% to over 23 billion dollars. Tokenized private credit dominates the category, comprising 58% of the market, with tokenized U.S. Treasurys at 34%.

Key players are venturing into the industry. On June 5, Pan-European investment manager APS bought $3.4 million of tokenized real estate bonds. In the meantime, tokenized credit and real estate platforms such as Benji and MetaWealth keep expanding. This Chainlink-JPMorgan-Ondo partnership is another confirmation of the institutional drive toward on-chain settlement of regulated assets.

The success of CRE in facilitating DvP flows between Kinexys and Ondo is an indicator of the increasing comfort with the idea of utilizing blockchain to build financial infrastructure without sacrificing compliance or operational security.

Source: blockchainreporter