Key Takeaways:

- Chainlink is rapidly becoming the backbone of tokenized asset infrastructure across major financial institutions.

- Collaborations with Coinbase, Paxos, Fireblocks, and others are enabling secure, interoperable, and compliant real-world asset tokenization.

- Expert David Brodeur-Johnson views this convergence as a key milestone for institutional blockchain adoption.

Chainlink is now a cornerstone infrastructure layer supporting the tokenization of real world assets (RWAs).

As its technology is now integrated into Coinbase’s Project Diamond, Apex Group’s fund tokenization, and Paxos’ stablecoin system, the company is raising the bar for secure, interoperable, and compliant digital finance.

Coinbase’s Project Diamond integration, announced at Abu Dhabi Finance Week, marked a major leap forward. Project Diamond aims to streamline asset tokenization for institutional clients via the blockchain’s CCIP and Chainlink Functions.

These technologies enable tokenized assets to be seamlessly interactable over public and private blockchains. Under such arrangements, institutions such as Peregrine, under the regulation of Abu Dhabi Global Market, can handle entire asset life-cycles efficiently in accordance with global norms.

David Brodeur-Johnson, a principal at Forrester and fintech transformation observer for many years, emphasizes that Chainlink’s infrastructure is supporting “institution-grade assurance” in the new tokenized market.

He views such moves as turning points in countering long-standing issues of security and transparency that in the past discouraged institutional investors from going entirely onchain.

Stablecoin Issuers Gain a Secure Launchpad with Chainlink

Stablecoin issuers such as Paxos, Bancolombia’s Wenia, and Usual are increasingly relying on the infrastructure of Chainlink to facilitate transparency as well as cross-chain compatibility.

Chainlink’s Proof of Reserve (PoR), Data Feeds, and CCIP constitute the technological backbone for the issuers to verify reserves and increase interoperability.

Paxos’s integration of its Price Feed for PayPal USD (PYUSD) provides dependable pricing data in real-time on Ethereum, promoting greater utilization in payment and trading environments.

In the process, Wenia has incorporated PoR into its minting procedure to prevent overissuance of its COPW token, a necessary step given Latin America’s increasing demand for stable digital currencies.

Usual’s application of Chainlink solutions for USD0 and USD0++ further supports the flexibility of this infrastructure. Employing a burn-and-mint system driven by CCIP, usually makes these tokens transferable back and forth between Base and BNB Chain without sacrificing security or reserve precision.

Tokenized Funds Enter the Spotlight

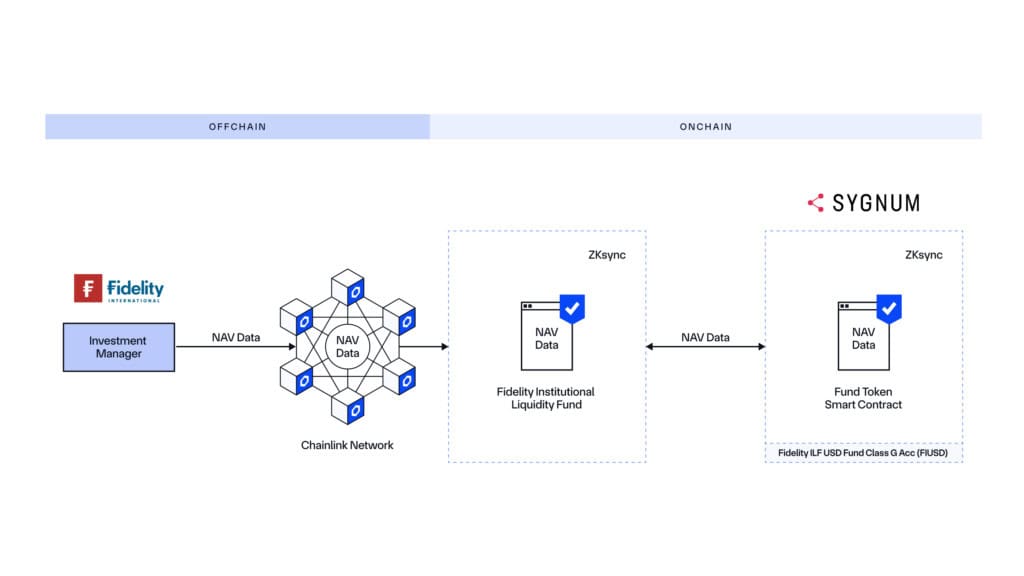

In the asset management space, Chainlink is enabling a new era of fund tokenization. Collaborations with Fidelity International, Sygnum, and Fortlake Asset Management have brought onchain NAV reporting and fund issuance into the mainstream.

With services such as Data Feeds and PoR, assets such as Superstate’s USTB and Apex-Fasanara’s FAST attain real-time transparency and quicker settlement.

Among the highlights of integrations, Spiko brought Ethereum-native money market funds to the front, backed by Europe’s regulated UCITS. Now that NAVs are live on Ethereum through Chainlink, Spiko is spearheading a new generation of institutionally compliant, digital-native investment products.

Source: Tronweekly