Corporate clients face persistent obstacles when sending funds internationally, creating an opportunity for banks that can streamline processes. Fintech companies continue to capture market share while established institutions explore blockchain solutions to maintain competitiveness.

These organisations encounter high transaction costs, unpredictable settlement times and operational inefficiency when moving money across borders, leading to strain in relationships with banking partners.

A new Deloitte report outlines how industry initiatives to assess digital currency movement across borders are gaining momentum.

By converting regulated assets such as commercial and central bank deposits into digital tokens, payment processors could enable instant transactions that settle immediately on unified ledgers. This round-the-clock movement of tokenised currencies requires fewer intermediaries, potentially reducing transaction costs significantly.

Persistent challenges in international transfers

Wholesale payments—transactions exceeding US$100,000—constitute the majority of cross-border volumes. These typically flow through correspondent banking networks that connect financial institutions to foreign markets where they lack physical presence.

While payments between major financial centres typically require only one correspondent bank, exotic currency conversions may need multiple intermediaries.

Each correspondent bank must update balances in connecting institutions’ accounts, a process that normally occurs during domestic business hours, creating significant delays between regions with large time zone differences.

Recent improvements from SWIFT and The Clearing House have advanced payment modernisation.

However, transactions requiring multiple correspondent relationships remain cumbersome and expensive. Each intermediary imposes fees for processing, settlement and currency exchange, forcing originating banks to commit additional funding to cover unexpected expenses or currency spread costs.

Consortium approach gathers momentum

Tokenisation could reduce compliance costs by embedding security checks directly into transaction flows. Unlike conventional transfers that separate payment instructions from funds, blockchain-based transfers of tokenised currencies integrate messaging with money movement.

Banks can programme smart contracts to execute payments automatically when specified conditions are met.

Stablecoins—digital tokens issued by a bank or private entity and pegged to a single asset like the US dollar—offer a clear path forward for wholesale cross-border payments in the near term.

The United States is expected to follow other jurisdictions in advancing legislation on stablecoins, with recent draft bills receiving bipartisan support.

Several global banks have begun testing cross-border payments on shared ledgers using tokenised versions of traditional currencies. In late 2023, transactions went live on Fnality, a UK-based payment system that links domestic settlement systems with a blockchain platform that exchanges utility settlement coins, which represent digital cash.

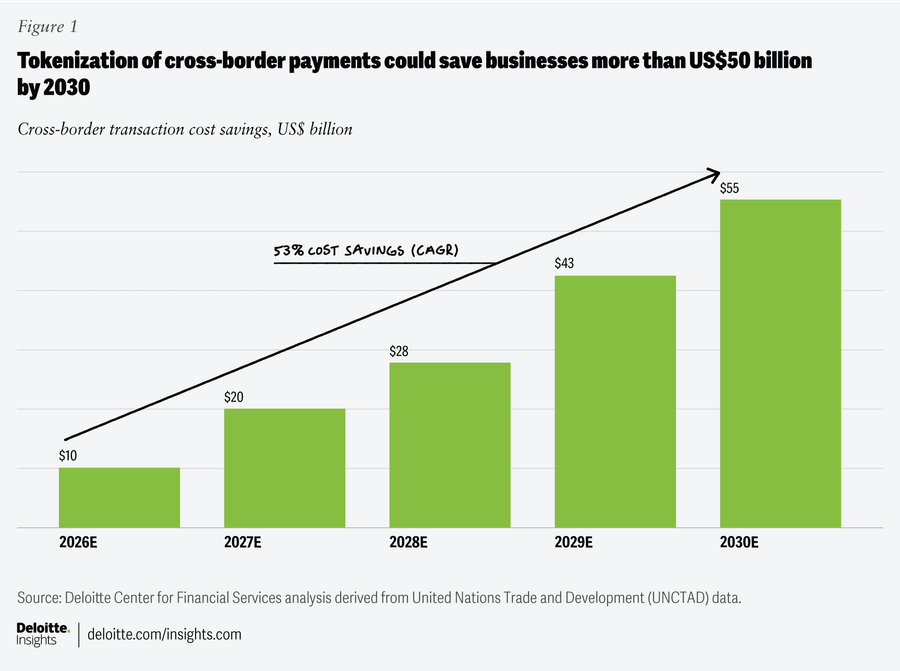

The Deloitte Centre for Financial Services predicts that one in four large-value international money transfers will settle on tokenised platforms by 2030. The efficiency gains could lower corporate cross-border transaction costs by 12.5%, generating savings of more than US$50 billion for business customers by the end of the decade.

Banks that wait on the sidelines may find themselves at a competitive disadvantage to others that arrive earlier. To maintain strong relationships with corporate customers, institutions should advance innovative payment solutions and strategic partnerships for cross-border transactions.

Regulatory challenges remain

Another challenge stems from synchronising digital ledgers with legacy domestic settlement networks. Many settlement systems operate on decades-old technology built when paper processes first migrated to electronic platforms. These legacy systems have functional limitations that constrain data and asset sharing.

Some governments are working with banks to develop unified settlement systems for traditional and tokenised currencies.

The Institute of International Finance, a global association of financial institutions, has gathered seven central banks and 41 financial organisations to cooperate on Project Agorá, a public-private partnership led by the Bank for International Settlements.

This collaboration aims to deliver a working prototype for multicurrency transfers on a unified ledger, with technical research scheduled for completion by end-2025.

The race to real-time payment capabilities is accelerating. Banks should continue to experiment and collaborate with industry groups to reduce inefficiencies in the underlying ledger technology while partnering on research for digital identity management.

Source: fintechmagazine