The market for tokenized real-world assets (RWAs) is estimated to reach $18.9 trillion by 2033. Industry experts believe that this forecast may even be conservative, as stablecoin adoption indicates a much larger market expansion.

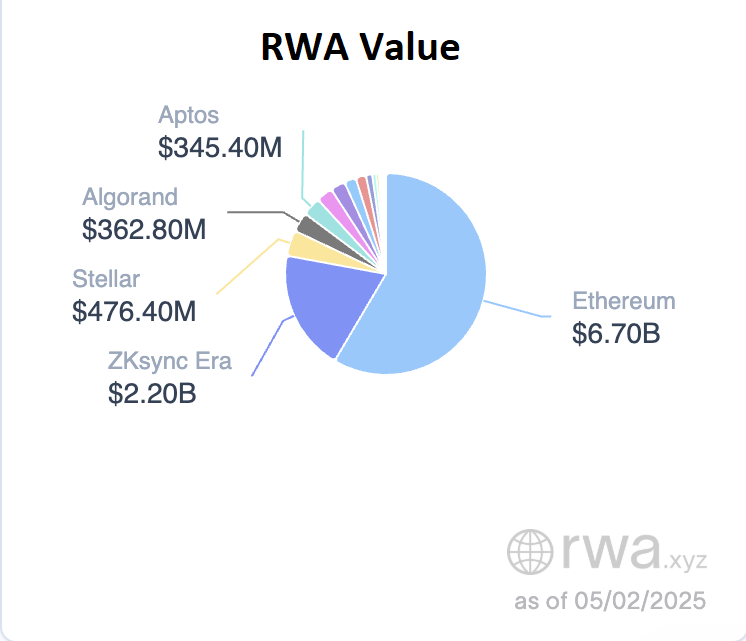

The rapid growth of tokenized RWAs is also boosting blockchain adoption metrics, as 60% of RWA tokenization value is being driven by Ethereum.

Stellar Focuses on Billions in Tokenized RWAs

But Ethereum isn’t the only Layer-1 (L1) blockchain contributing to the growth of tokenized RWAs.

Denelle Dixon, executive director of Stellar Development Foundation, told Cryptonews that the Stellar network ranks second, right behind Ethereum, for the most tokenization use cases.

“Stellar is the second largest Layer-1 for RWA value after Ethereum, with around $470 million in tokenized treasuries, commodities, and yield-bearing stablecoins on the network,” Dixon stated.

Dixon elaborated that in November 2019, Franklin Templeton—one of the world’s largest financial institutions—started planning to build a tokenized money market fund on Stellar.

Franklin Templeton has since grown its “OnChain U.S. Government Money Market Fund” (FOBXX) to be the third-largest tokenized money market fund. The fund is available on Ethereum, Coinbase’s Layer-2 Base, Aptos, and Avalanche, but the Stellar network functions as the primary blockchain.

According to Dixon, the OnChain U.S. Government Money Fund has about $701.7 million in total asset value, with the majority of $466.5 million being on the Stellar network.

“By tokenizing securities, this integration enables institutions to reduce transaction costs from $1 to less than a penny—the $50,000 cost of 50,000 transactions becomes just $120,” Dixon noted.